Intro

There are millions of everyday products we use, from milk bottles and pharmaceuticals to clothing and carpet, that are made from ethylene which is a gas made from derivatives of oil and gas and is the world’s largest single building block in the petrochemical industry. Although most consumers don’t give it much thought, it took a complex process and some risky decisions to produce the ethylene that went into making those products. The most savvy and successful businesses in the ethylene supply chain are using analytic modeling to manage that complex process to make better decisions, reducing their risk, and improving their bottom line.

Problem

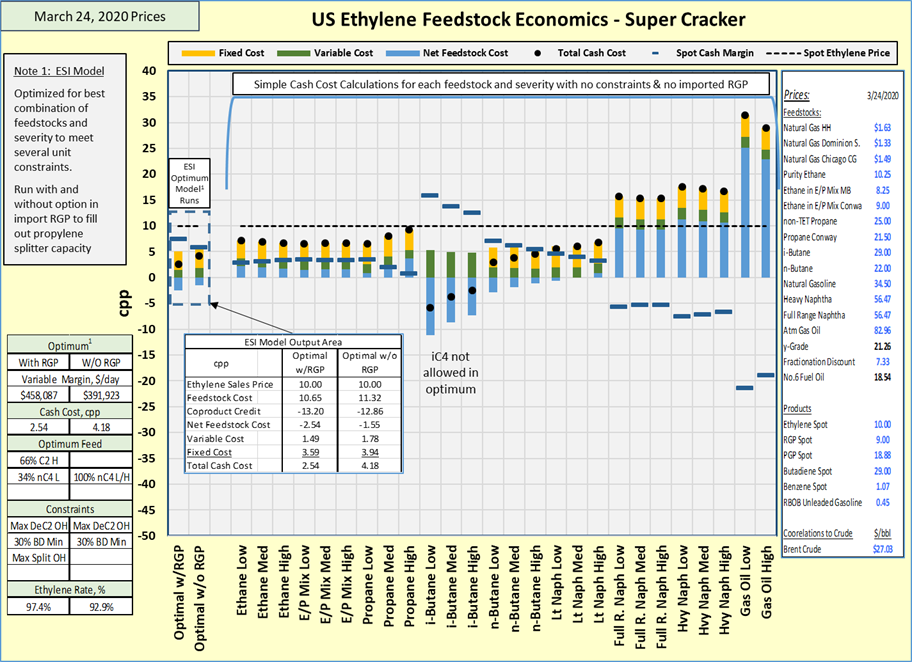

There are approximately 60 ethylene plants currently in the US, producing and selling around 90 billion pounds per year. These plants’ operations are subject to a very complicated economic model. Since market prices for the feedstocks and products in and out of these plants can quickly change due to changes in the supply and demand of their associated markets, economics can vary widely even on a daily basis. Operators use these economic models to quickly determine the best way to operate their plants and also use them to formulate plans for future operations so that feedstocks can be purchased and products can be sold into the future.

Solution

“We were looking at both Solver and PIMS. Once we saw how easy and slick Solver was, I decided to cancel our subscription to PIMS. Later on, we even upgraded our Solver account.”

With over 100 years of industry experience, Ethylene Strategies International (ESI) is an advisory firm for companies in the ethylene value chain. To help their clients make critical decisions, ESI built a set of simulation and optimization models using Analytic Solver for Excel to forecast market supply and demand as well as forecast monthly prices for the next 24 months and annual prices through 2035. Companies use this data to decide production levels and set their pricing for maximum profits.

Outcome

Companies who subscribe to these models are able to make informed decisions today that will mitigate future risk and improve their bottom line.

In this industry, adjusting the price up or down even by one cent can translate into billions of dollars gained or lost. But by using the forecasts created through ESI’s analytic models, businesses have saved multi-millions and made multi-millions.

There have been numerous times when ESI’s forecasts indicated the market was going short and prices would go up. Because of that, many of their clients stocked up on inventory at a low price and then sold when price was high and made a substantial profit.

“This is a grand time to be using Solver software because it really will give us some insight ... I like that the team at Frontline is constantly trying to improve. Smart people.”

Interested in trying Analytic Solver for your business problem? Click here to start a free 15-day trial.